The closing documents transfers ownership to the buyer. To bring any property sales transaction to a close you will have to sign many documents may contain information about your loan, mortgage details, deeds, trusts, etc. Reviewing and signing these documents is the most important part of any closing. An error in any of these documents can delay the closing process.

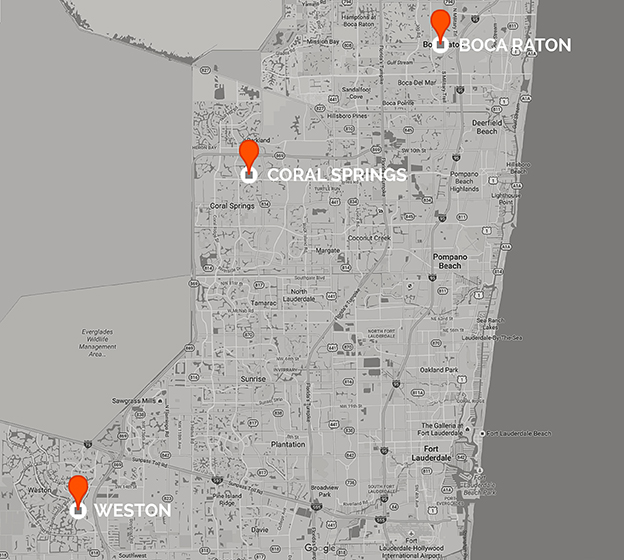

A Coral Springs real estate attorney can familiarize you with the closing documents in advance, so that closing process goes smoothly. Only after you have reviewed and signed all the documents, will you legally become the new owner.

Here are some of the common types of closing documents:

Mortgage documents

Important information about your loan such as terms, closing costs, and interest rates are laid out in this document. Review the document thoroughly before signing for any mistakes such as spelling errors etc.

Closing disclosure

It contains information about your mortgage. This document is provided to the buyer at least three days before the closing, to give the buyer a chance to understand what’s on the loan estimate.

The Title and Deed

This title indicates ownership of the property and the deed is the document showing ownership and is the instrument by which title is conveyed.

Escrow statement

This document contains information about the escrow account, including the funding of the account, and the payments the lender will make on your behalf. These payments usually include property taxes and insurance.

Mortgage note

The document states the buyer will repay the mortgage ina reasonable time. It also contains information about the terms of the mortgage as well as the outcome if the buyer fails to provide the mortgage payment on time.

Certificate of Occupancy

This document states the property meets all the requirements to move into a newly constructed house.