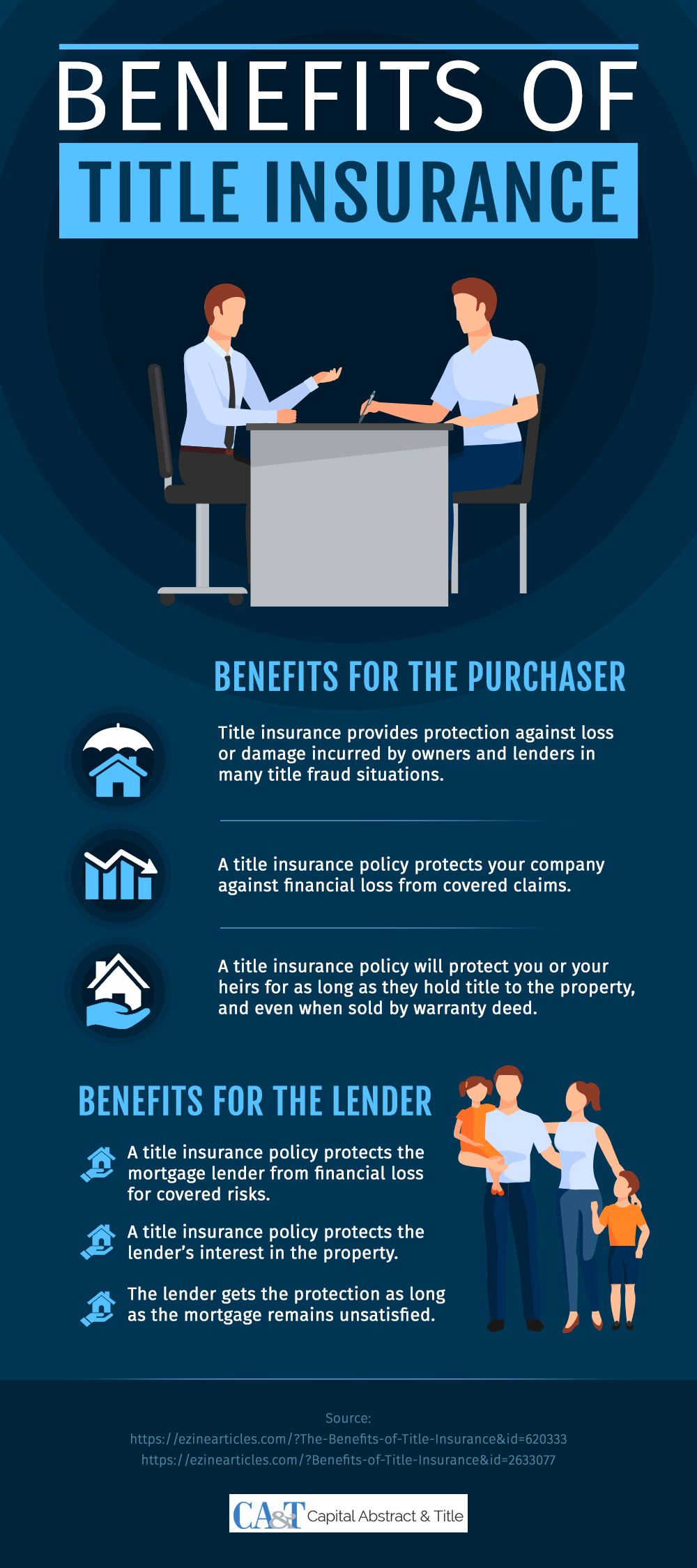

This infographic titled ‘Benefits of Title Insurance’ lists the benefits of buying title insurance for both the property purchaser and the mortgage lender. A property title is proof of the land’s ownership. Title insurance is meant to protect the property owner against any loss due to a claim on the property.

Benefits for the purchaser

Personal protection: Title insurance provides protection against loss to the property owner in case of property title fraud. Any threat to the property title will jeopardize the investment in the property.

Group protection: If the land was bought for a commercial purpose any threats to the property title will affect the purchasing company. Commercial properties are typically quite expensive and the financial ramifications to investors could be considerable.

Protection for heirs: Title insurance also protects future generations for as long as they hold the property and even after it’s sold by a warranty deed.

Benefits for mortgage lenders

Protection against financial loss: A mortgage lender’s return depends on the property owner’s ability to pay back the loan. A financial loss to the purchaser will directly affect the owner’s ability to pay back the mortgage, resulting in loss of investment.

Protection for investors: Any threats to the title ownership also threaten the interests of the mortgage lender’s investors.

Protection for the life of the loan: Title insurance protects the lender as long as the mortgage remains unsatisfied.

For more information, please refer to the infographic below.