When you purchase a property, it is important that you protect your investment from past and future legal issues. This can be done with title insurance.

What is title insurance?

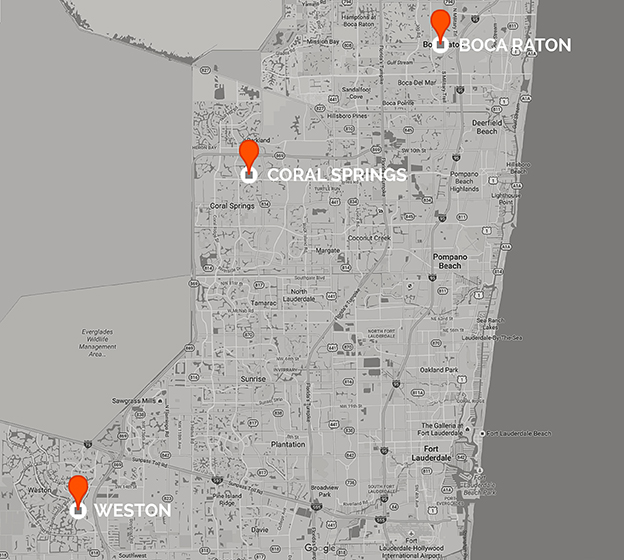

Title insurance is a type of indemnity insurance that protects against a loss of title or ownership of a property due to a defect in the original title deeds. Most mortgage lenders require title insurance. Title insurance Boca Raton minimizes loss by protecting the property owner or the lender from any past or future legal claims that may be or have been made on the property.

Who does it protect?

Title insurance Coral Springs protects both the property owner and the lender. Unlike other insurance policies, which protect against future events, a title insurance Parkland policy also protects against any past claims. This can be a third party that had a past claim against the property and did not file it for past owners to handle.

Types of title insurance:

There are two types of title insurance:

Lender’s insurance (loan policy): This Parkland title insurance protects the lender(s) against any loss for as long as they have an interest in the property. This insurance is usually covered for the duration of the mortgage loan. The loan policy is usually included in the loan amount, with the liability decreasing as the mortgage is paid.

Owners’ insurance (owner’s policy): This protects the property owner(s) and their heir(s) for as long as they own the property. This type of Coral Springs title insurance is used to pay for defense against any valid claims on the title.

Why do you need Boca Raton title insurance?

- Both the buyer and lender need title insurance to protect themselves against any future claims on the property.

- The seller often takes out title insurance as a gesture of good faith to show that the title is clear.

Contact Capital Abstract & Title to get assistance with protecting your investment.